Downloads

Keywords:

AI-Driven Algorithmic Trading: Integrating Machine Learning, Hybrid Technical Indicators, and Risk Management for Momentum Strategies

Authors

Abstract

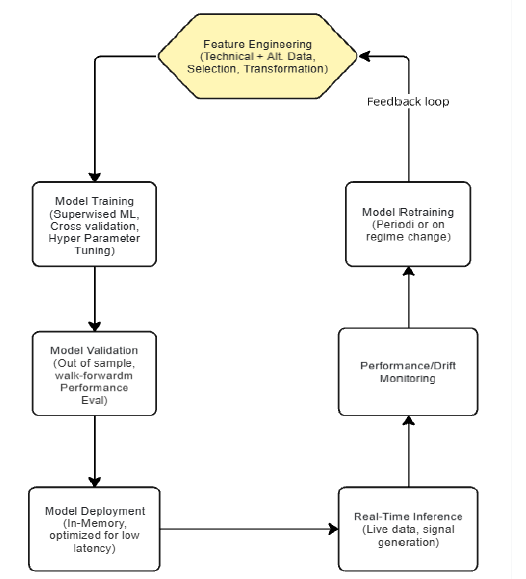

Algorithmic trading has transformed financial markets by enabling automated, data-driven decision-making at scale. However, many existing systems suffer from fundamental architectural limitations: predominant use of rule-based strategies with limited indicator combinations (typically 1-3 technical indicators), static signal generation logic that cannot adapt to changing market regimes, inadequate real-time data validation leading to spurious trades from stale or erroneous data, and siloed risk management systems that operate independently from signal generation. These design constraints result in suboptimal performance, increased drawdowns, and reduced profitability—particularly during high-volatility periods when market dynamics shift rapidly. This paper addresses these fundamental challenges by presenting an AI-driven, real-time algorithmic trading system for U.S. equities, designed to answer: Can the integration of supervised machine learning, hybrid technical indicators, and dynamic risk management significantly outperform traditional rule-based approaches in both returns and risk control?

The proposed system integrates supervised machine learning, hybrid technical indicators (VWAP, MACD, RSI, Bollinger Bands), and dynamic risk management to overcome traditional limitations. It leverages multiple real-time market data providers and alternative data sources (such as news sentiment) to generate high-confidence trading signals while eliminating data reliability issues. Key innovations include topgainer filters and advanced selection criteria for momentum trading during high-activity periods, addressing the timing and selection weaknesses of conventional systems. The modular, configurable platform supports rapid adaptation to changing market conditions and features robust data validation—including multi-provider checks and gap-filling—to ensure signal reliability and eliminate data-driven false signals.

Backtesting and live trading simulations across diverse market conditions demonstrate up to 14% higher returns and 7% lower drawdown compared to traditional rule-based strategies, with a Sharpe ratio improvement from 0.8 to 1.7. These results highlight the substantial performance gains achievable by addressing the core architectural limitations of existing algorithmic trading systems through integrated AI, hybrid indicators, and adaptive risk management, demonstrating clear superiority over conventional rule-based approaches.

Article Details

Published

Issue

Section

License

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.