Downloads

Keywords:

Fraud Detection: Leveraging Artificial Intelligence to Identify Transaction Anomalies in Real-Time and Minimize False Positives

Authors

Abstract

Financial fraud has become an increasingly complex and persistent threat in the digital economy, with billions lost annually due to unauthorized or deceptive transactions. Traditional rule-based systems and manual review processes are often insufficient in keeping up with the speed, volume, and evolving tactics of fraudsters, especially in real-time environments. Furthermore, these systems are plagued by high false positive rates, which lead to unnecessary transaction declines and customer dissatisfaction.

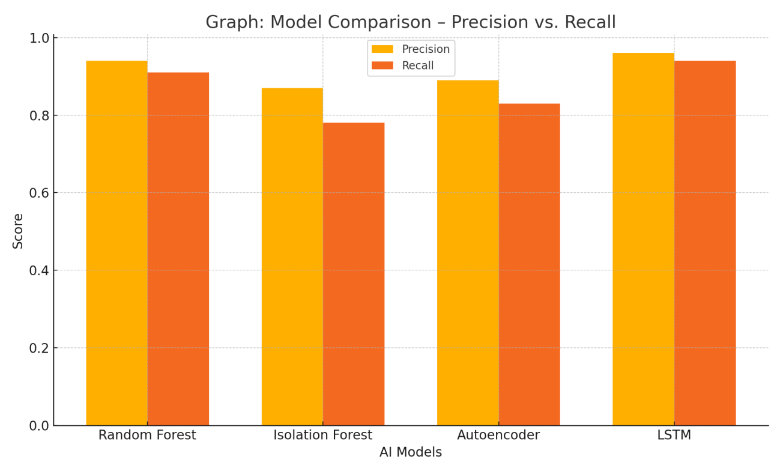

This study investigates the application of artificial intelligence (AI) and machine learning (ML) techniques in detecting fraudulent transactions by analyzing behavioral patterns and anomalies in real time. The paper explores the use of advanced algorithms including Random Forest, Isolation Forest, Long Short-Term Memory (LSTM) networks, and Autoencoders to classify transaction data and reduce the occurrence of false positives without compromising detection accuracy.

A comparative evaluation is conducted using a publicly available and anonymized credit card transaction dataset. The data is preprocessed to address class imbalance and enhanced through feature engineering. The selected AI models are then trained and tested under real-time conditions, and their performance is assessed using key metrics such as Precision, Recall, F1-Score, Area Under the ROC Curve (AUC), and detection latency.

The experimental results reveal that deep learning models, particularly LSTM networks, are highly effective in learning temporal transaction patterns and detecting fraud with a reduced false positive rate. Additionally, unsupervised models like Isolation Forest show promise in identifying novel fraud patterns. Visualization of results through performance graphs and latency comparison tables further underscores the models’ efficiency in operational settings.

This paper concludes that AI-powered fraud detection not only enhances the accuracy of identifying illicit activities but also ensures operational efficiency by reducing unnecessary intervention. The findings advocate for the integration of real-time AI systems into digital payment infrastructures to foster a secure and customer-centric financial environment. Future research directions include deploying federated learning approaches for privacy preservation and enhancing model explainability to meet regulatory compliance.

Article Details

Published

Issue

Section

License

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.